Form 709 2024

Form 709 2024. This form can be complicated—especially for expats. What is the annual gift tax exemption?

Updated on december 15, 2023. First, complete the general information section on part one.

Marketingmathewslawpllccom January 5, 2024 Estate Planning, Tax 2024 Gift Tax Exclusion, Form 709, Gift Tax, Tax Exemption.

Story by elizabeth constantineau, ai editor.

Effective January 1, 2024, New Federal.

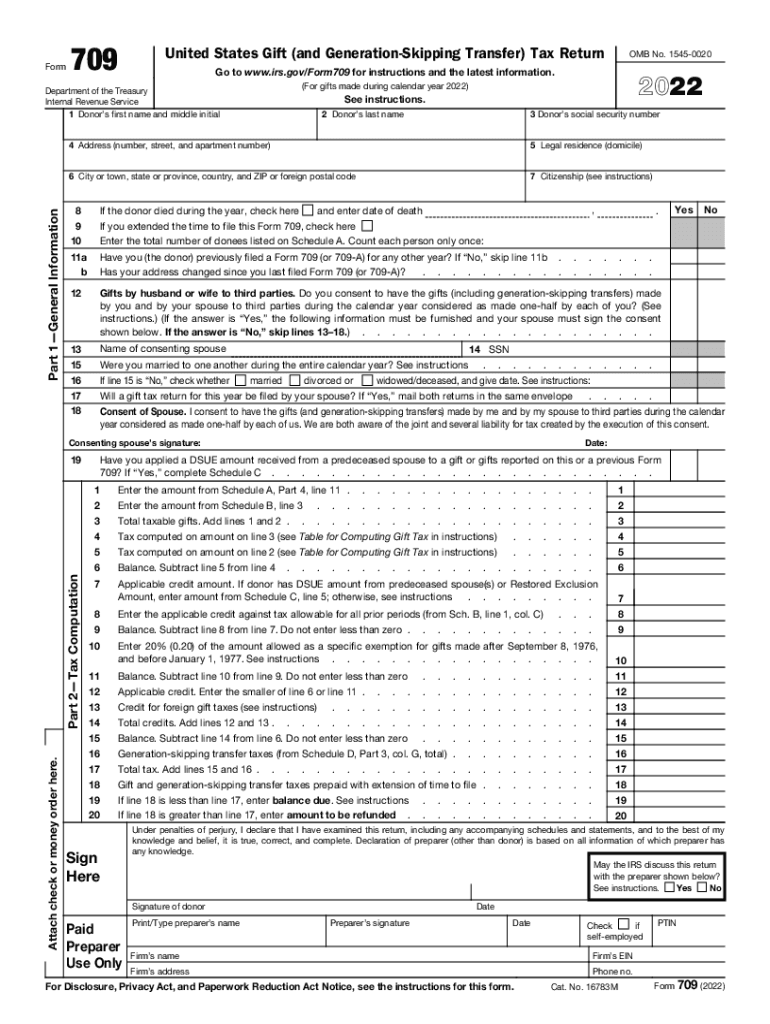

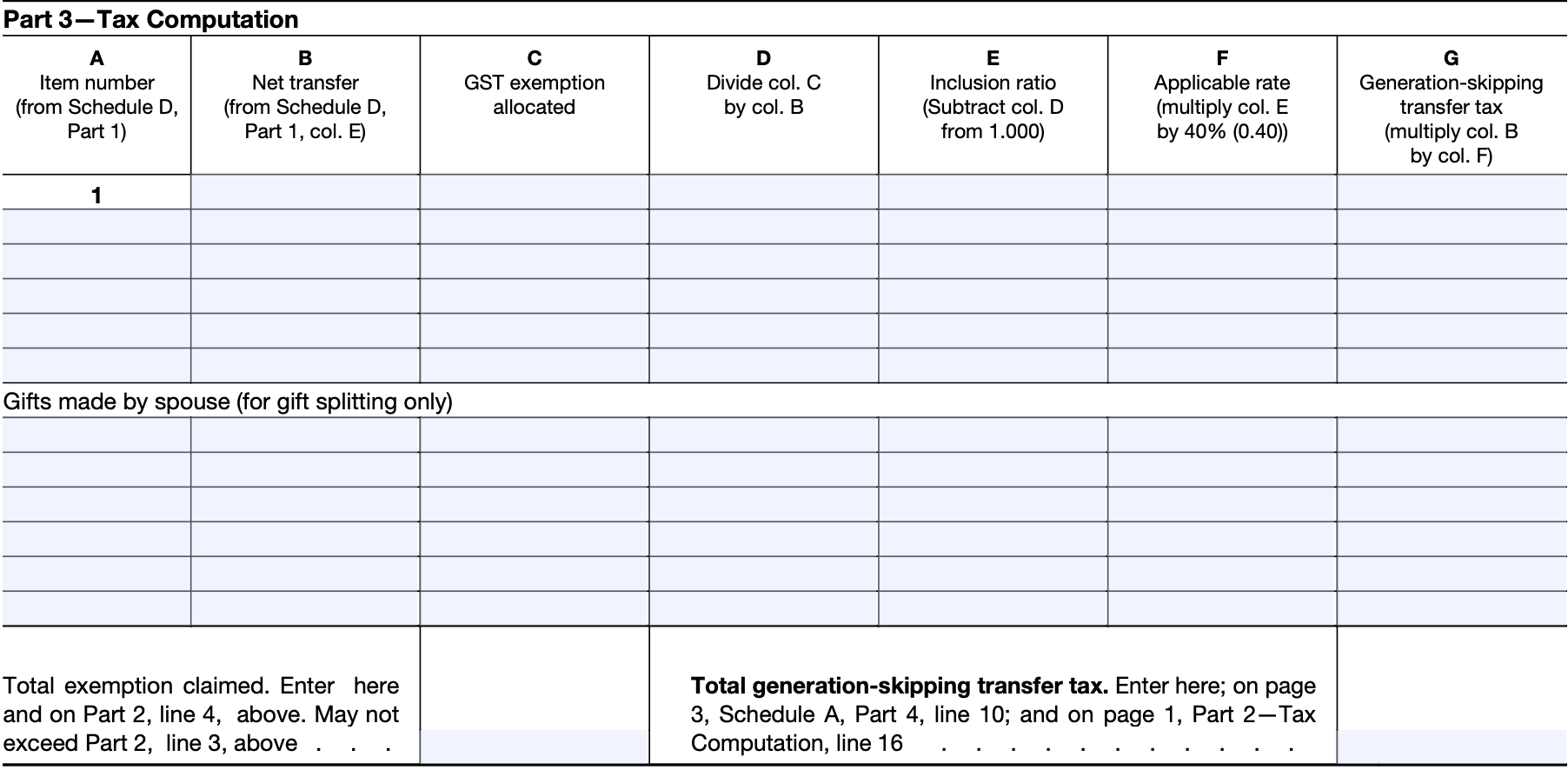

Form 709 is a tax form used in the united states to report gifts that exceed the annual gift tax exclusion.

Ugc Net June 2024 Application Form:

Images References :

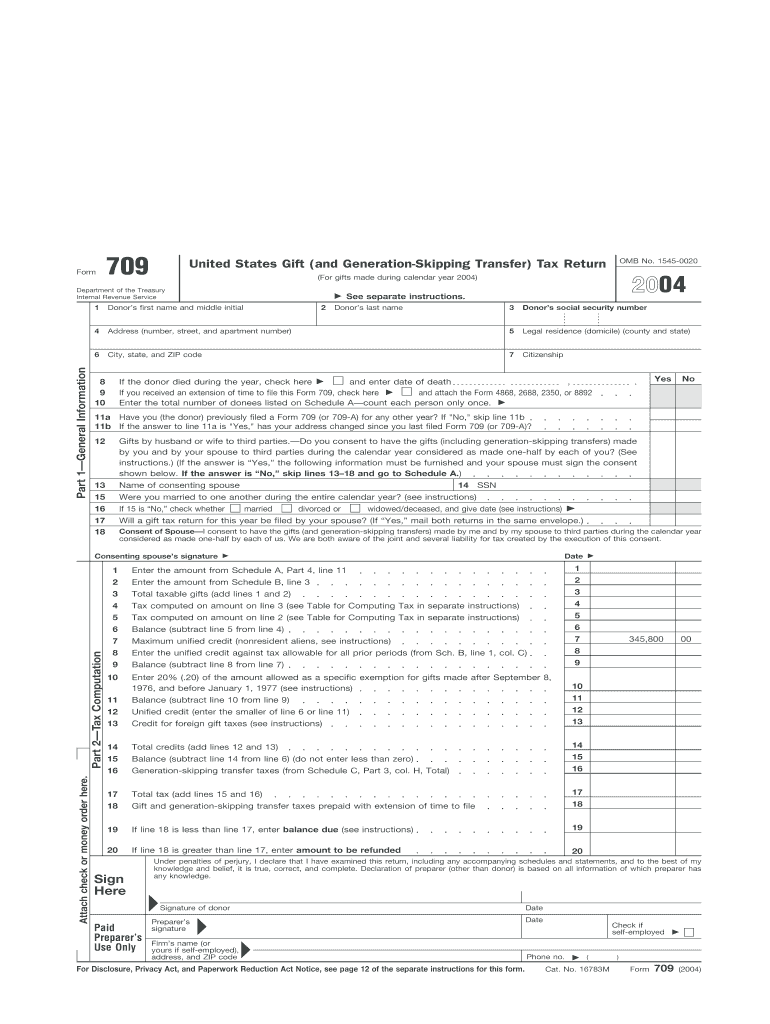

Source: www.signnow.com

Source: www.signnow.com

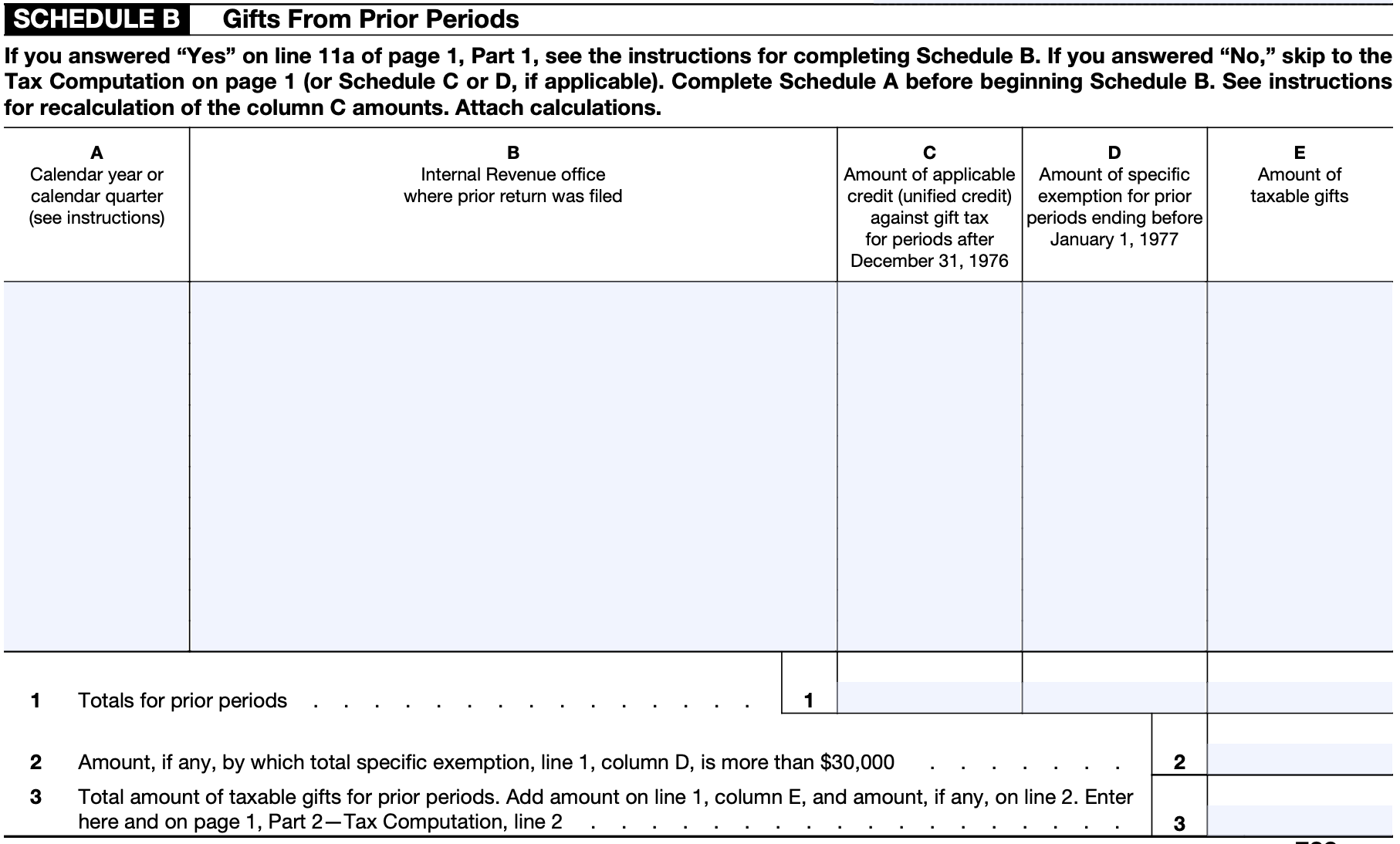

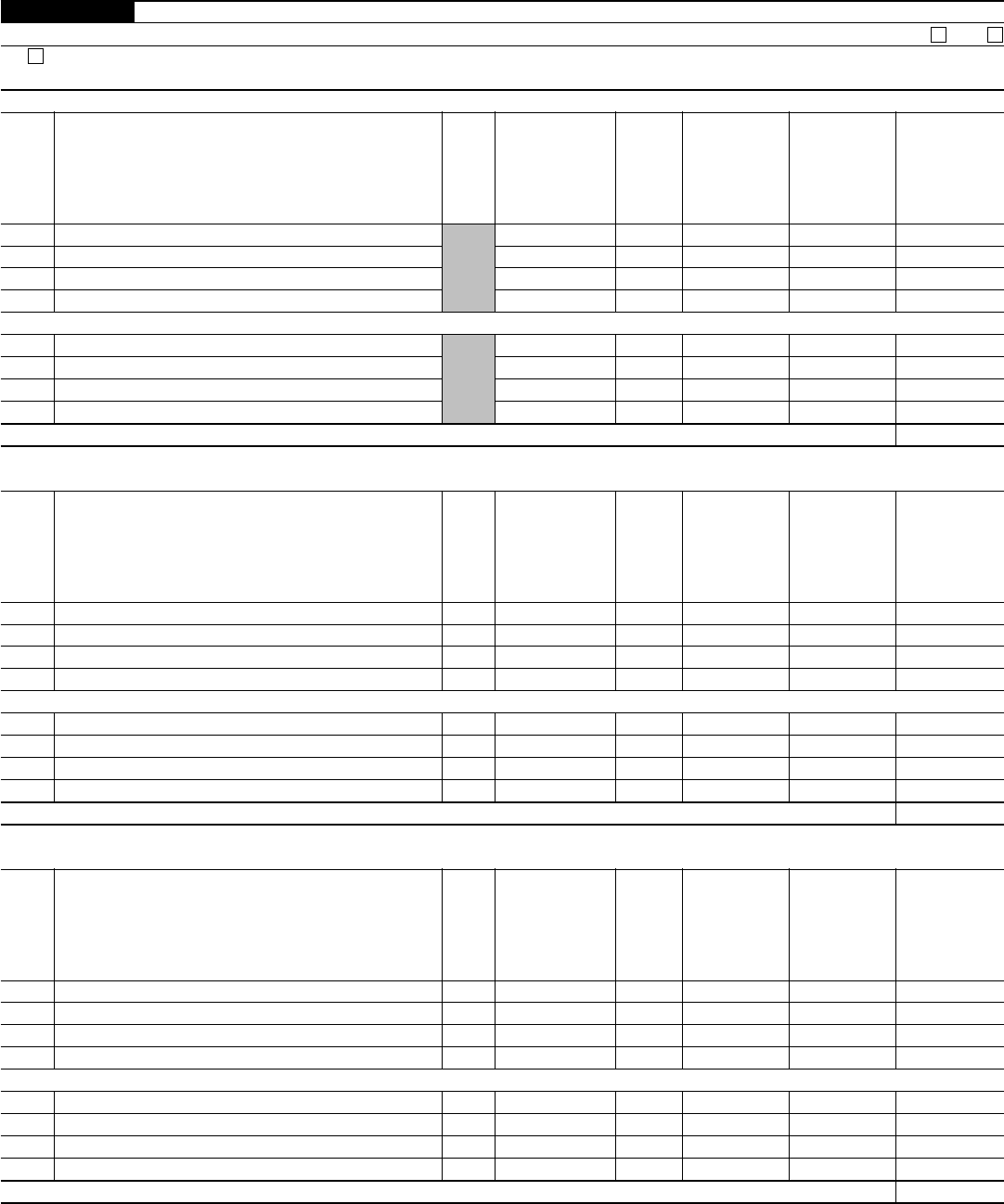

709 20222024 Form Fill Out and Sign Printable PDF Template, Explore our detailed guide on form 709 for foreign corporations in the u.s., covering filing requirements, gift tax intricacies, strategic planning, and faqs. 1 what is irs form 709.

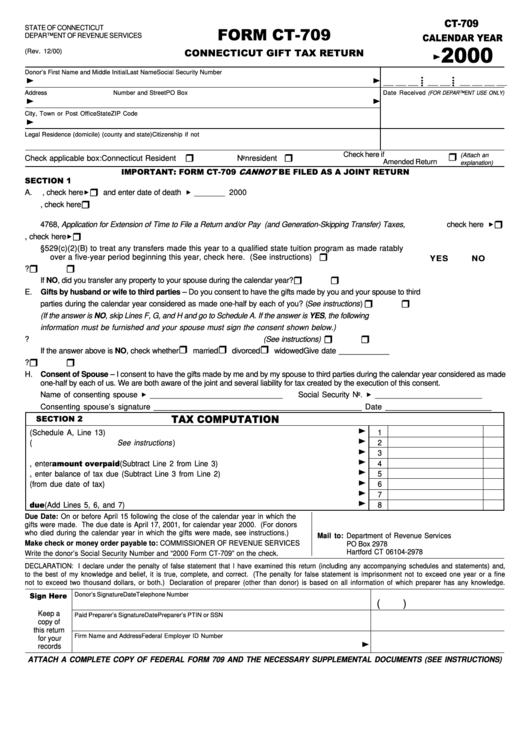

Source: mungfali.com

Source: mungfali.com

709 Form 2005 Sample 3B4, 4 the form 709 is different than form 3520. Ugc net june 2024 application form:

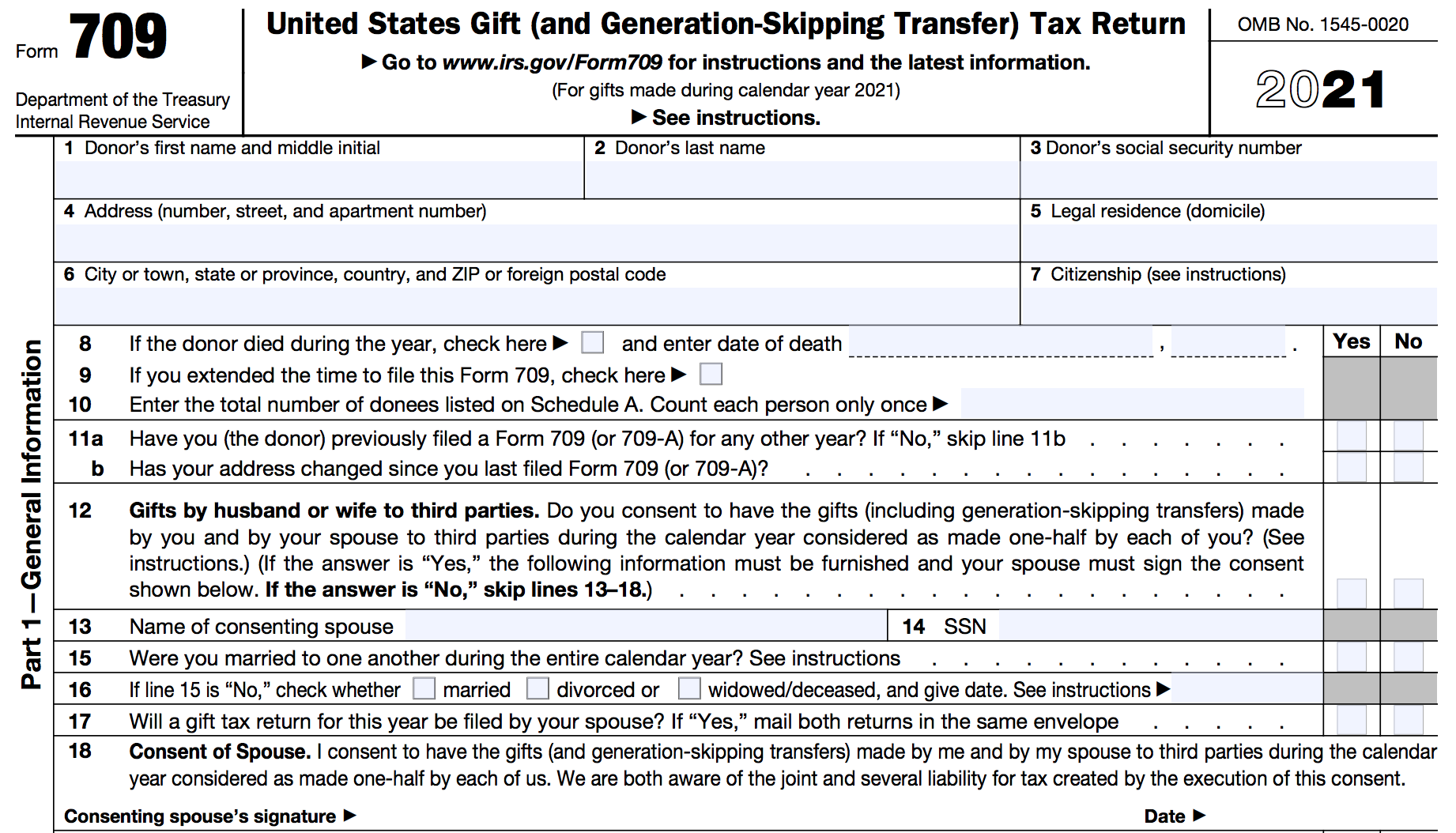

Source: smartasset.com

Source: smartasset.com

How to Fill Out Form 709 SmartAsset, In this example, we look at a taxpayer who gifts cash of $19. (do you owe taxes on your dad’s gift?) watch on.

Source: smartasset.com

Source: smartasset.com

How to Fill Out Form 709 StepbyStep Guide to Report Gift Tax, Effective january 1, 2024, new federal. What is the annual gift tax exemption?

Source: handypdf.com

Source: handypdf.com

Form 709 Edit, Fill, Sign Online Handypdf, Written by javier simon, cepf®. Explore our detailed guide on form 709 for foreign corporations in the u.s., covering filing requirements, gift tax intricacies, strategic planning, and faqs.

Source: www.signnow.com

Source: www.signnow.com

709 Form Fill Out and Sign Printable PDF Template signNow, What is the gift tax limit? Form 709 is a tax form used in the united states to report gifts that exceed the annual gift tax exclusion.

Source: mungfali.com

Source: mungfali.com

Federal Gift Tax Form 709 Gift Ftempo ED4, A gift tax return, represented by irs form 709, is used to report gifts that exceed the annual gift tax exclusion amount, which is $18,000 as of 2024. 3 not everyone giving gifts must file a form 709.

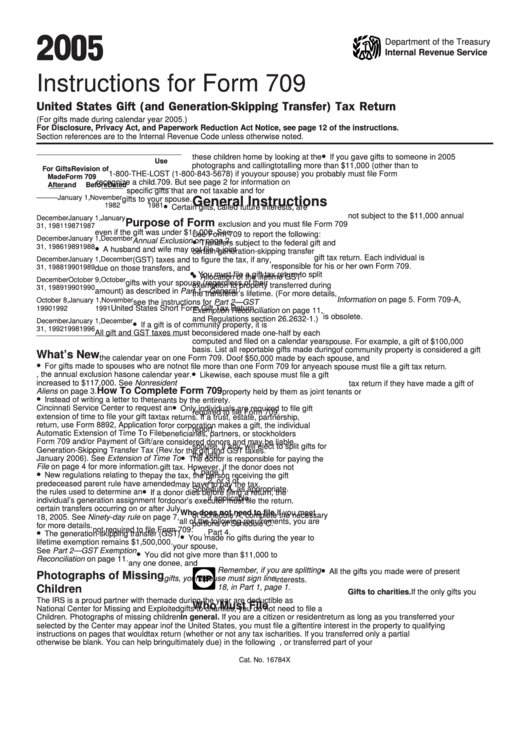

Source: www.formsbank.com

Source: www.formsbank.com

Instructions For Form 709 United States Gift (And GenerationSkipping, First, complete the general information section on part one. In this example, we look at a taxpayer who gifts cash of $19.

Source: smartasset.com

Source: smartasset.com

How to Fill Out Form 709 StepbyStep Guide to Report Gift Tax, Explore our detailed guide on form 709 for foreign corporations in the u.s., covering filing requirements, gift tax intricacies, strategic planning, and faqs. Ugc net june 2024 application form:

Source: mungfali.com

Source: mungfali.com

Federal Gift Tax Form 709 Gift Ftempo ED4, Effective january 1, 2024, new federal. Marketingmathewslawpllccom january 5, 2024 estate planning, tax 2024 gift tax exclusion, form 709, gift tax, tax exemption.

Story By Elizabeth Constantineau, Ai Editor.

If you gifted more than this sum, you must file a federal gift tax return, form 709, in 2024 [0]

3 Not Everyone Giving Gifts Must File A Form 709.

For tax year 2023 (taxes filed in 2024), you could have.