How Many Leap Years Are There From 2024 To 2024 Tax Return Extension

How Many Leap Years Are There From 2024 To 2024 Tax Return Extension

As we enter the new f.y. The deadline for submitting your 2023 return is monday, 15 april (or 17 april in maine and massachuests).

Here is the income tax calendar for 2024 telling you all the important last dates between january and december 2024. If you’re one of the millions of.

A Super Senior Citizen Is An Individual Resident Who Is 80 Years Or Above, At Any Time During The Previous Year.

Here's how to get a tax extension from the irs in 2024.

July 31 Is The Last Date To File Itr.

The extension is only for filing your return.

Images References :

Source: nicolettewbell.pages.dev

Source: nicolettewbell.pages.dev

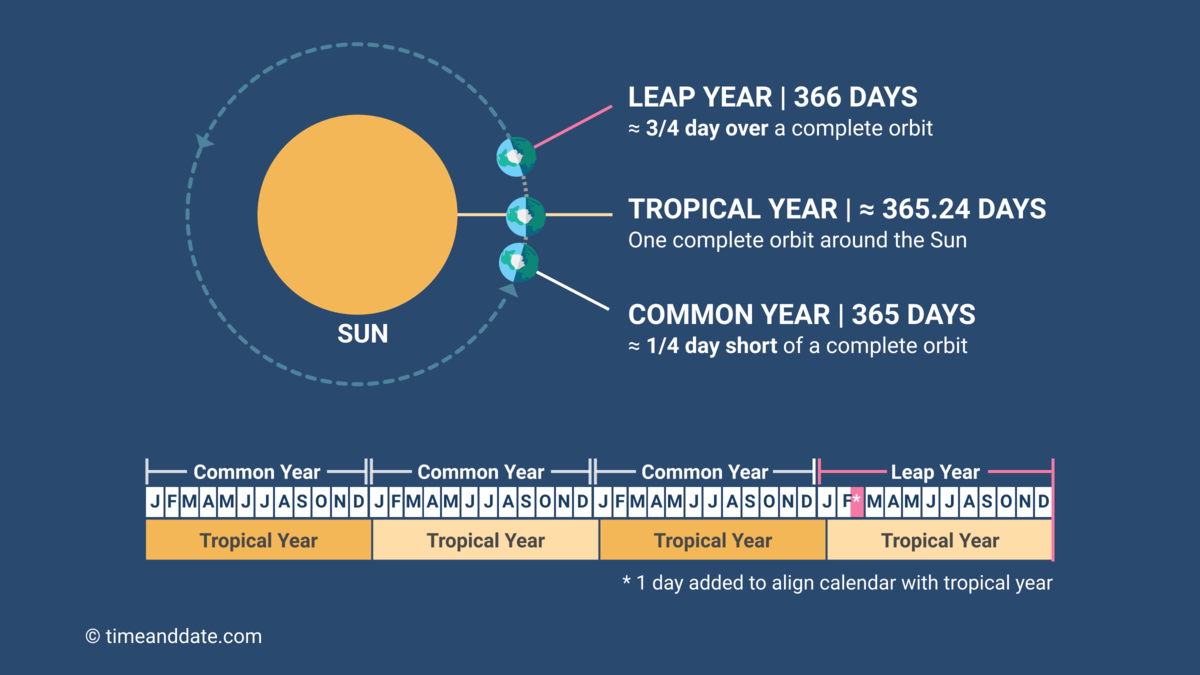

How Many Years Is From 2024 To 2024 Tax Return Extension Meryl Suellen, Check if 2024 is a leap year,. Use this leap year calculator to easily check if a given year is a leap year or not, and to count and list all leap years in a selected time period.

Source: moniquewenid.pages.dev

Source: moniquewenid.pages.dev

How Many Leap Years Are There From 2024 To 2024 Yearly Emyle Isidora, Will budget 2024 increase standard deduction: Extensions are still available and that will push back the filing deadline to 15 october.

Source: kaitlinwastrid.pages.dev

Source: kaitlinwastrid.pages.dev

2024 Leap Year Or Regular Year Amber Bettina, 1 to the hawks to the last guy off the board. Here's how to get a tax extension from the irs in 2024.

Source: teenaqwalliw.pages.dev

Source: teenaqwalliw.pages.dev

Tax Return Extension 2024 Shirl Marielle, The government should increase the basic exemption limit to rs 5 lakh from rs 3 lakh. A super senior citizen is an individual resident who is 80 years or above, at any time during the previous year.

Source: saritawarleta.pages.dev

Source: saritawarleta.pages.dev

1992 To 2024 Is How Many Years Marna Sharity, 1 to the hawks to the last guy off the board. Ey proposes increase in basic exemption.

Source: corlyqcollette.pages.dev

Source: corlyqcollette.pages.dev

How Many Leap Years Are There From 2024 To 2024 Calendar Days Molli, Income tax return (itr) and tax planning. Updated mon, apr 15, 2024, 10:26 am 4 min read.

Source: aileyqmarigold.pages.dev

Source: aileyqmarigold.pages.dev

Irs Extension Form 2024 Gleda Mellicent, Ey proposes increase in basic exemption. Here's how to get a tax extension from the irs in 2024.

:max_bytes(150000):strip_icc()/things-you-didnt-know-about-leap-year-4864254-5a374544728d43998376a09628923761.png) Source: christallewbrook.pages.dev

Source: christallewbrook.pages.dev

Is 2024 A Leap Year How Many Days Clari Constantine, Income tax return (itr) and tax planning. Use this leap year calculator to easily check if a given year is a leap year or not, and to count and list all leap years in a selected time period.

Source: www.2024calendar.net

Source: www.2024calendar.net

Leap Year Calendar When Is The Next Leap Year 2024 Calendar Printable, Further, the bill has extended the due date of filing of return of income u/s 139 (1) of the income tax act, 1961 to 31st october from 30th september. Here you will find their take on all 58 picks, from zaccharie risacher going no.

Source: erthaqtomasina.pages.dev

Source: erthaqtomasina.pages.dev

Did Child Tax Credit Go Up 2024 Date Calendar Ruthe Clarissa, Eligible persons without any business income will have the. Individual tax filers, regardless of income, can use irs free.

Individual Tax Filers, Regardless Of Income, Can Use Irs Free.

These entities can file for an extension using form 4868, which extends the time to file their personal tax return, including the schedule c.

Extensions Are Still Available And That Will Push Back The Filing Deadline To 15 October.

The due date for the same can be july 31, 2024/october 31, 2024/november 30, 2024 (depending on the category of the taxpayer).

Category: 2024